Small Business Cash For Very Easy Interest Financing With Low Access

Invox Finance Pty Ltd was founded by a member of ABR Finance Team Pty Ltd, a successful invoice financing company based in Australia. As our team is undergoing an expansion phase, visit our website (www.invoxfinance.io) for the most up to date information on our team.

What is Invoicing Financing?

Traditional invoice funding is based on the purchase of invoice financiers from the seller.1 In return, the financiers agree to forward money to the seller against each invoice. Buyers who buy the seller's products must pay the invoice directly to the investor.

What's the main problem with traditional Invoice Financing?

The main problem with traditional invoice financing is that the investor buys an invoice from the seller and advances the funds against it has no direct relationship with the buyer. The financiers simply trust the information provided by the seller. As a result, the relationship between the seller and the buyer is not completely transparent to the investor, and therefore exposes the financier to a considerable risk of unpaid invoices as agreed or disputed.

How does the Invox Finance Platform solve the problem?

The Invox Finance platform is a decentralized peer-to-peer invoicing loan platform that will enable sellers, buyers, investors and other service providers to connect, interact, share directly and distribute information. The platform aims to create environmental trust by facilitating transparency between parties and satisfactory performance. This platform will disrupt and revolutionize traditional invoicing of financing by implementing a system where trust and transparency between all parties is developed through the reward system it contains. In addition, the execution of transactions and information flows will not depend on a single centralized service provider, but instead is governed by a fully transparent set of transparently executed ledgers distributed.

Who will use our system?

- Investors are looking for higher returns and diversification of their investment portfolios.

- Sellers that have invoices they want to sell to accelerate their cash flow.

- Buyers who will receive an invoice payment period extend and become valued to verify the invoice.

Do system users need to know anything about blockchain?

No, the user interface on the Invox Finance Platform creates a smooth user experience. In particular, the user interface will allow all payments to be made in fiat currency by utilizing our API banking partners.

What is Invox Token?

Invox Token will be created on Ethereum network using ERC-20 Standard and will have the following utilities:

- providing access to the platform through Trusted Members

Program and

- The prize work is done for the platform. That is, the system will reward buyers and sellers with Invox Tokens for verification invoices, invoicing and settlement payments. The Trusted Members program gives vendors an incentive to store more Invox Tokens by allowing access to higher invoice financing rates. Buyer and Investor will not be required to withstand any Invox tokens.

How can I get involved?

We raise funds to develop systems, market services and build communities. The founding team will invest $ 500,000 cash in cash upon completion of the ICO. Invox Finance intends to offer Invent Tokens to institutional and retail investors to help fund the evolution of invoice financing. You can also get involved with joining the Invox Finance community and participate in the bounty program.

Why should I participate in Initial Coins Offer?

Invox Token will grant the right of its holder to access the Invox Finance Platform through the Trusted Members Program. By participating in the two-stage ICO Invox Finance, you will be provided with the opportunity to earn Invent Tokens at a discount.

How are our ICOs run?

ICO is run in two parts with bonus systems that benefit participants in pre-ICO as well as during ICO itself.

Other Financing Options for Sellers

In addition to Invoice Financing, small businesses also have several other financing options available to them to lighten periodic cash flow issues.

Bank overdraft

Banks will generally provide an overdraft if a guarantee is provided as security. If a business has no real asset whatever the bank will accept as collateral (such as real estate), the bank will generally be very reluctant to give an overdraft guarantee to the business.

Peer-to-Peer

Recently, a number of online lending platforms of peer-to-peer invoices entered the market. These platforms directly link invoicing sellers with investors and seek to automate a number of processes involved in traditional invoice financing.

Unsecured business loan from a non-banking financier

The interest rate charged by this financiers is usually very high (ie in the order of 40% to 70% per annum) with the principal payments and the required interest must be made every week. For many businesses with cash flow problems this will not fix cash flow problems and can actually worsen it.

Solid

There are also new entrants to the market

- Large-scale invoicing discount platform is implemented on the Ethereum Network. Comparison between the Populous platform and the Invox Finance Platform is outlined.

Invox Token

In conjunction with the Invox Finance Platform, Invox Tokens will become created on Ethereum Network. The invox token will use a standard ERC-20 token and will have the following utilities:

The reason behind doing ICO is to pre-sell membership to the system through the sale of Invox Tokens. While sellers may obtain membership through either purchasing Tokens or their invox results through awards for verification and invoice payments, initially all sellers must purchase an Invox Token (either at ICO at a discounted rate or from Invox Finance Platform) to be able to withstand the required number of tokens to access Invox Financial Platform on their required financing limits. For this reason there should also be an initial token inventory when Invox Financial Platforms are introduced.

The final amount of Invox Token printed will be released on our website at www.invoxfinance.io. The founding and advisory teams will be allocated part of the Invox Token, which will be locked in the Testament. This amount will be calculated by multiplying the number of tokens sold by 0.20. Invox tokens will also be set aside for operational funds. This amount will be the Early Coins Offering calculated by multiplying the number of tokens sold by 0.20. In addition, there will be an invox Token set aside for prize rewards and airdrops programs. This amount will be calculated by multiplying the token selling amount of 0.05. All Invox Token will be made at one time, after the conclusion of ICO.

The maximum Invox inventory amount that may be printed Token will be 464 million. This is based on the maximum possible bonus rate, maximum allocation (as listed above) and token conversion 1ETH = 10,000 INVOX.

It should be noted that the average bonus rate in ICO will be lower than the maximum possible bonus rate. For this reason the total supply will likely be lower.

Citizens and residents of the United States of America, China or any citizen who prohibits ICO or cryptocurrency will be unable to participate in the ICO.

Provide access

Invox Token will provide sellers with access to the Invox Finance Platform. Through the Trusted Members Program each seller will be asked to hold a certain number of Invox Tokens to gain access to higher invoice financing rates.

Reward Work Performed

This system will reward buyers and sellers with Invox Tokens for verification and invoice payment.

Draft explanation of a video

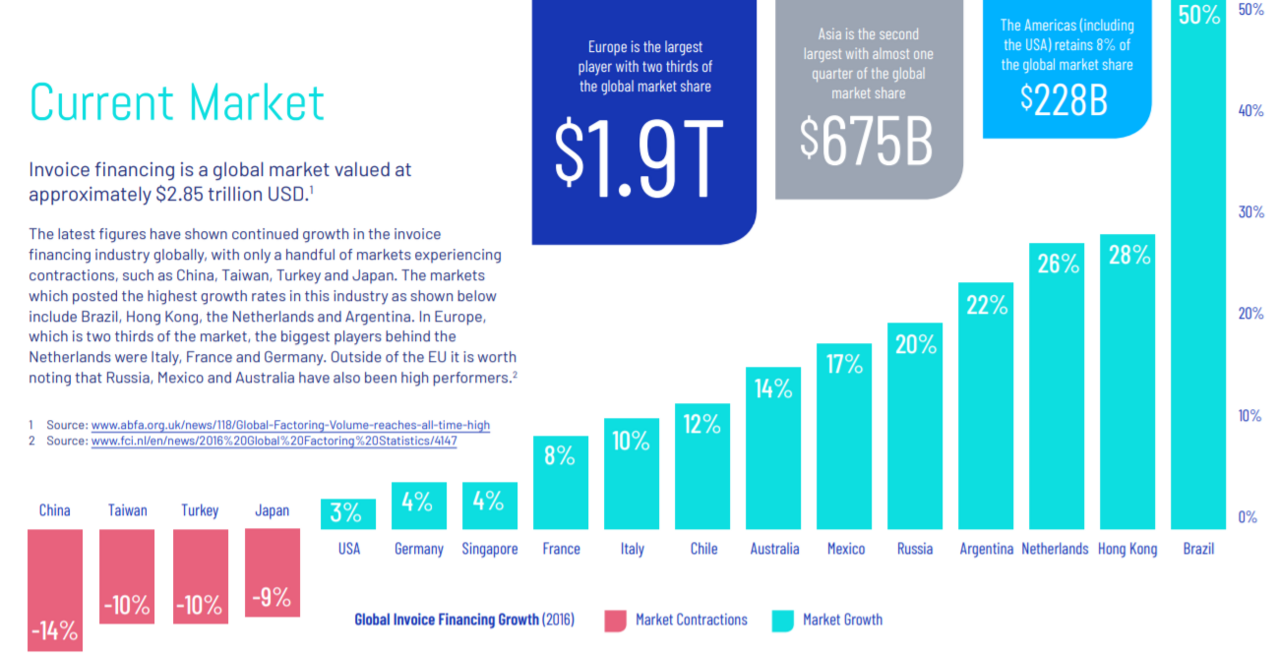

Why Should Invoice Financing Grow?

Traditional models expose financiers to substantial risks and increase the likelihood of disputes. It's time for a change.

6 Weaknesses of Traditional Invoicing Financing

No direct contact

Financiers have no relationship with the buyer, which exposes the investor to considerable risk.

Invalid invoice

Seller may issue invoices for incomplete services or products that do not meet the requirements.

High legal costs

Preparation and implementation of expensive legal documents and usually involve third party providers.

Defrauding

Sellers and buyers can conspire to fool the financiers. Or the seller may violate their agreement and request a direct payment.

Dispute

Buyers can dispute payment obligations and leave others out of the bag, put their reputation on the line.

Insolvency

Buyers can become bankrupt and can not afford to pay the bills, forcing others to suffer loss of funds.

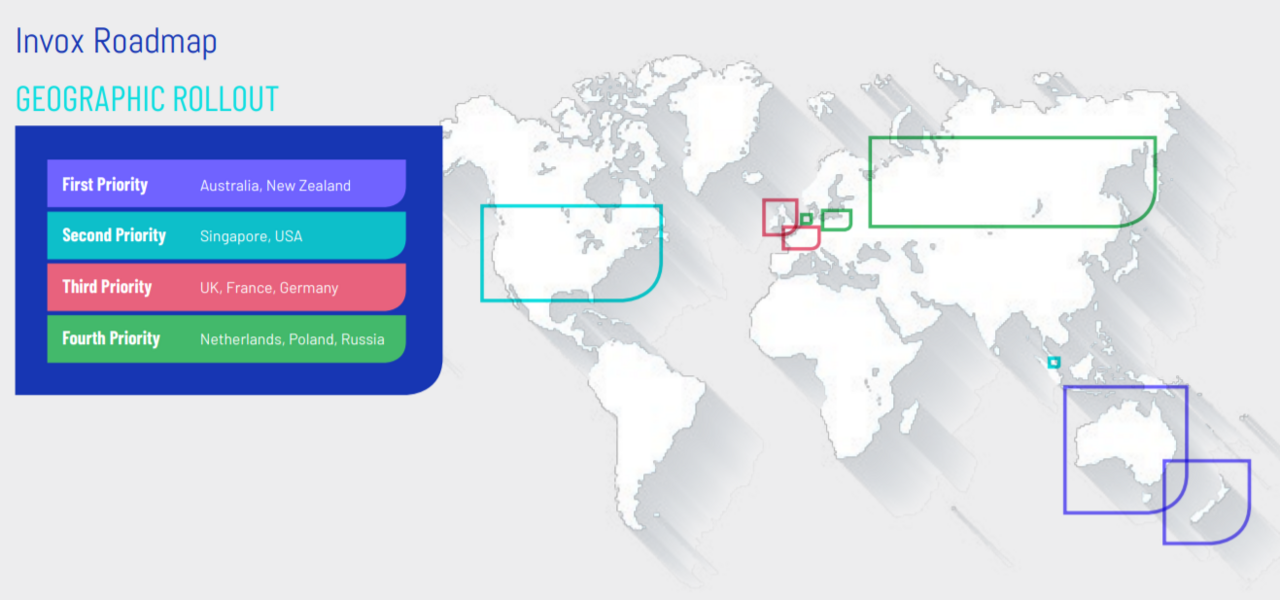

Roadmap

For more information :

Website: https://www.invoxfinance.io/

Telegram: https://t.me/InvoxFinanceCommunity

Author : jack bangor91

Profile Link : https://bitcointalk.org/index.php?action=profile;u=1762924

My ETH : 0xE1A8b563857484228567aeCbc0781600931508E9

Komentar

Posting Komentar